Sustainability is a multifaceted topic and can be interpreted in different ways. The variety of definitions of sustainability can become a problem, for example, when it comes to the question of what exactly sustainable management is. The European legislator has also recognized this. One important economic sector that is dealing with this challenge is finance. With the help of a uniform classification system, a taxonomy, the EU wants to standardize sustainability for financial products . What at first glance seems to be relevant only for banks and other financial institutions will also entail considerable information and documentation Company for small and medium-sized enterprises .

What is the EU taxonomy?

A taxonomy is a procedure that systematically subdivides and classifies concepts by creating categories. The EU taxonomy was published as part of the 2018 "Action Plan: Financing Sustainable Growth" presented by the European Commission. A key objective is to redirect capital flows into sustainable investments.

This requires a uniform definition of what sustainable activities are, in order to obtain clear criteria for sustainable financial products such as funds, green bonds or financial investments. This is intended to improve the transparency of companies in terms of sustainability and counteract greenwashing. It is also aimed at providing incentives for sustainable investments.

How are activities classified as sustainable?

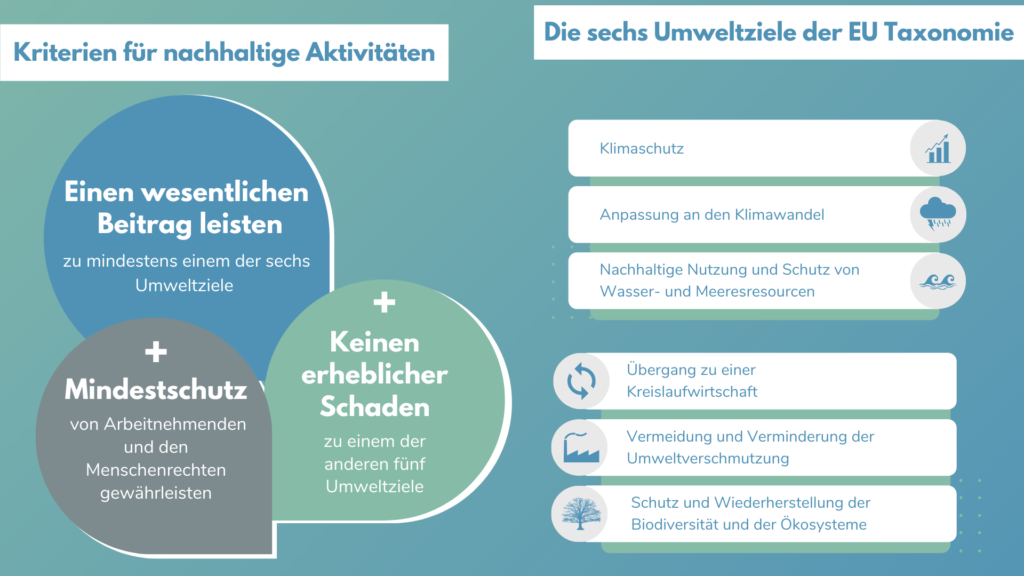

The taxonomy assesses the extent to which an economic activity is environmentally sound (Environment), socially responsible (Social) and whether it corresponds to the principles of good corporate governance (Governance). Six goals have been defined so far for the area of environment. (1) climate protection; (2) adaptation to climate change; (3) sustainable use and protection of water and marine resources; (4) transition to a circular economy; (5) pollution prevention and control; and (6) protection and restoration of biodiversity and ecosystems.

An economic activity is considered environmentally sustainable if it

makes a significant contribution to at least one of the specified objectives,

the other objectives are not compromised,

and a minimum level of protection of workers and human rights is ensured.

Furthermore, the regulation covers three different classes of environmentally sustainable activities:

Activities that contribute to sustainability.

Transitional activities: These activities support the transition to a carbon-neutral economy, but cannot yet be implemented in a more environmentally sustainable manner.

Enabling Activities: These are necessary for enabling for one of the first two activities. These include, for example, the production of solar panels needed to generate renewable energy (Category Activity 1).

The EU taxonomy provides for an additional information requirement for implementation. The regulation thus supplements defined disclosure requirements to the EU's "Regulation on sustainability-related disclosure requirements in the financial services sector" already published in 2019. In the course of this, there will also be new reporting obligations for capital-oriented companies from 2022.

The current status of the EU taxonomy

The taxonomy regulation entered into force on July 12, 2020, although the elaboration of some criteria is still ongoing. The regulation will then be applicable from January 01, 2022. Providers of sustainable funds will then have to prove to what extent they have used the taxonomy in determining sustainability, and banks will also increasingly pay attention to these sustainability criteria - also when granting loans.

What does it mean for companies, especially SMEs?

The EU taxonomy can initially be a major challenge for companies, especially SMEs, due to additional information and documentation requirements. Even if they are not directly affected in many cases, they may be indirectly affected by it as suppliers to companies subject to reporting requirements or when seeking financing. For example, business partners that are subject to reporting requirements under the EU taxonomy need information on the sustainability of all elements of their suppliers. If your own company is part of this chain, it should be prepared to provide information on EU taxonomy criteria.

This also becomes important when external financing is planned in the company. Banks have various obligations. In order to be able to fulfill them, they will increasingly focus on the sustainability characteristics of the financed activity, also when granting loans.

However, the EU taxonomy also offers opportunities for SMEs. If the company offers solutions in one of the three classes of environmentally sustainable activities, the modernization of the company can benefit from green financing instruments and realize large investments, e.g. through green bonds vis-à-vis donors and other stakeholders or to fulfill subsidies..

By loading the video, you accept YouTube's privacy policy.

Learn more

How can I, as an SME, prepare for the EU taxonomy today?

In this case, it is better to be safe than sorry. The changeover period until 2022 can be used to prepare for the requirements. Even if the reporting obligation does not directly affect one's own company, the topic will become more relevant in financing.

In order to be able to check its company for taxonomy compliance, it needs data, software and procedures for evaluation, which must then be checked and audited. It therefore makes sense to develop a strategy today and to create responsibilities within the company at an early stage.

WeShyft will integrate the EU taxonomy as a standard for reporting.

We help you to fulfill the documentation and information requirements of the EU taxonomy. Sign up for our newsletter and get informed as soon as we launch this feature.